The bubble can either involve the overall stock market, exchange-traded funds (ETFs) or shares in a particular sector.

The housing bubble in 2008 that led to a severe global recession is one of the biggest examples, though there have been smaller instances in the past as well.Ī stock market bubble usually involved inflated share prices that are often way higher than their company’s fundamental value including earnings and assets. When the bubble bursts, it leads to massive sell-offs and prices decline rapidly. Simply put, the bubble is created on the basis of speculative optimism or demand, rather than the financial asset’s real or fundamental worth. Read | Explained: Why Indian stock market remains immune to 2nd Covid-19 wave The five steps are displacement, boom, euphoria, profit-taking and panic. There are usually five stages to a financial or asset bubble and understanding each stage is essential to avoid wealth erosion.

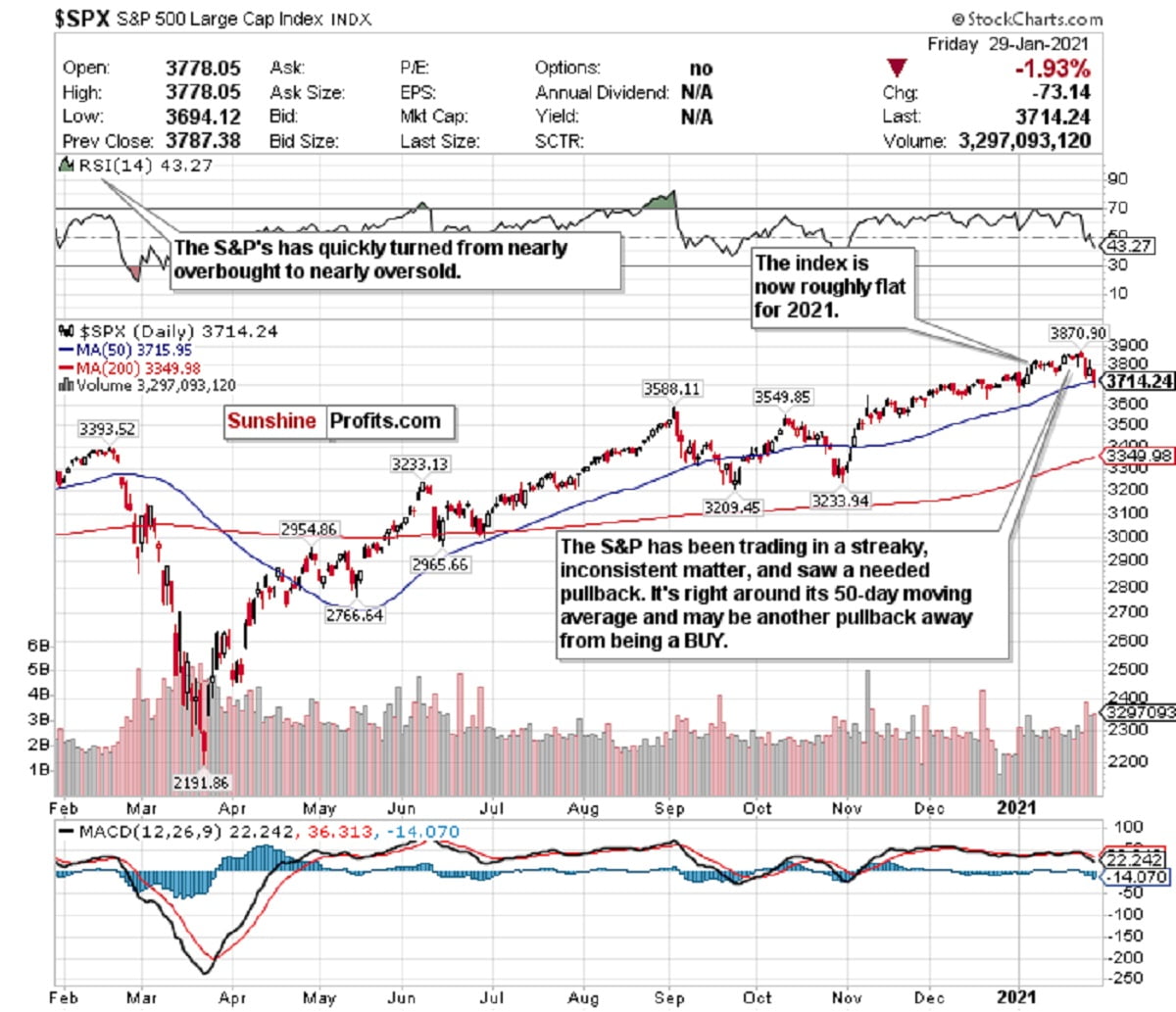

Stock market bubbles are usually hard to predict, especially for those who do not track the market in-depth on a daily basis.

0 kommentar(er)

0 kommentar(er)